Inclusive theatre, inheritance laws

My Death show, Jan 8th, Do Come! Inclusive family theatre, Justin Fletcher What inheritance law tells about a nation’s culture.

My Death show, Jan 8th, Do Come!

One thing I re-learnt

Peter Gray, Randomness and Agency

Inclusive family theatre, Justin Fletcher

What inheritance law tells about a nation’s culture

Thanks for coming to the Very Bigly Climate Game

Unofficial UnConference for EV winners + friends

If you are about about in London on Jan 8th, do come along to My Death Show. I’m unsure how many more runs it will have unless the piece is taken up professionally, but it has been moving and fulfilling to do and audiences have loved it. The show is good enough to go on further, but we will see. Free tickets here.

If you’ve ever wondered what song to have played at your funeral, this is the show for you! Ben has been to his own funeral five times so who better to accompany you on a weirdly fun and interactive look at the greatest certainty in life: death*.

(*Ben doesn’t die in the show).

"Super funny. Moving. Very informative. You think it's going to morbid but it isn't. Of course death is strangly taboo. That makes it funnier"

Free tickets here. Wed 8 Jan, 7pm

Justin Fletcher is a well-loved actor. He is famous in disability circles for his inclusive tv and theatre work. In particular he developed Something Special, which is designed to introduce children to Makaton signing, and is specifically aimed at children with delayed learning and communication difficulties.

I went to go and see Justin’s singalong in London’s Hyde Park as part of Winter Wonderland - a seasonal theme park.

I was going with my autistic son. I had not really thought about the theatre of world of Justin. I was quietly impressed by a few small things.

There were plenty of small theatrical gestures which pointed to a very expert and knowing theatre performer. In reality, you need to like or have some sort of relationship to Justin’s TV work to truly enjoy the show, but if you do then Justin really delights.

Justin is inclusive in his performing. He even uses the phrase “I see you…” to draw people in and to acknowledge his audience. He engages directly with his audience. There is no 4th wall in this performance.

Justin draws upon - what dramaturgs might name - Call and Response theatre.

Call and response theatre is a dynamic and interactive form of theatrical performance that emphasizes active audience participation. It draws inspiration from oral traditions, where a "call" from a performer (or leader) is met with a "response" from the audience. This method of engagement fosters a communal atmosphere, breaking down the traditional barriers between performers and spectators.

This method is also adjacent to Augusto Boal’s Forum Theatre.

My current line of performance-lecture work such as My Death Show uses this method, in essence, although with a less learned, more organic form of call and response.

There is a long history of this in English theatre in Pantomime and Punch and Judy.

Punch and Judy, a traditional form of puppetry that exemplifies elements of call and response theatre through its interactive and communal nature emerged as a street theatre form with roots in physical comedy and commedia dell’arte.

Originating in 17th-century England, Punch and Judy shows are characterized by their slapstick humor, exaggerated characters, and reliance on audience participation, making them a great example of theatrical engagement.

Call and Response in Punch and Judy:

Interactive Audience Dynamics:

Punch and Judy shows actively involve the audience in the storytelling. For example, the audience often warns Mr. Punch about the approach of a threatening character or reacts vocally to the antics on stage.

The puppeteer, hidden inside the booth, listens for audience reactions and adjusts the performance accordingly, creating a real-time dialogue.

Stock Phrases and Cues:

Performers use repetitive, familiar phrases or situations that cue audience responses. For instance, when Mr. Punch is about to be caught, children might shout, “He’s behind you!” or “Look out, Mr. Punch!”

Breaking the Fourth Wall:

Punch and Judy performances inherently break the fourth wall as the puppets "talk" directly to the audience, inviting them to become active participants in the show.

The audience’s reactions often influence the timing and pacing of the jokes or action.

Call-and-Response Humor:

Much of the humor in Punch and Judy relies on the audience's vocal contributions, like laughing, booing, or cheering at the puppets’ behavior.

For instance, Mr. Punch’s infamous catchphrase, “That’s the way to do it!” is a "call" that invites audience affirmation, laughter, or ironic agreement.

Justin utilised many of these theatrical elements. He had great physicality and interaction with the audience in a very inclusive way. His back up had good physicality too. It’s not the heights of high art ballet, but the short dance routines and the small amount of slapstick physical comedy was on point. The short dances were in sync and slick.

The audience themselves were half the show. Most were very involved and the knowledge of the songs and the responses definitely helped. Justin came across as humble - he thanked the audience for his 25+ year career - as this community has made him the star he is. I am sure continued playing of the same characters can be very draining, but at least on this show he was generous with his energy and spirit and the audience was pleased.

Justin trained at drama school and was inspired by physical comedy actors like Buster Keaton and Rik Mayall and had training from Jack Trip, a physical comedy master.

While Justin’s work had a particular impact with specific audiences, the performance skills that go into creating the work can be appreciated by all.

Here is small clip of us singing a section of his Something Special theme song, with makaton signing for some (and by background actors).

There has been a debate in the UK recently as the government is changing the tax law surrounding pensions and inheritance tax (aka estate tax, death tax).

I found this intriguing because of My Death Show where it is one idea amongst many that I explore. First, a little known English inheritance law.

What Happens If You Die Without a Will and Family?

If someone dies without leaving a valid will (referred to as dying "intestate") and without any close relatives, their estate will pass to the state under the Bona Vacantia rules:

England and Wales:

If no heirs can be identified, the estate is passed to the Crown. The Treasury Solicitor (via the Government Legal Department) administers these estates.

If you do not leave a will and have no surviving relatives under the intestacy rules, this process applies.

Cornwall and the Duchy of Lancaster:

If the deceased person was domiciled in Cornwall and died without a will or relatives, the estate is passed to the Duchy of Cornwall.

Similarly, estates in the Duchy of Lancaster are passed to the Duchy under the same circumstances.

I think this is interesting as many nations will give the estate to the state, but England is unique in having some estates essentially go to the royal family (Duchy of Lancaster and Cornwall).

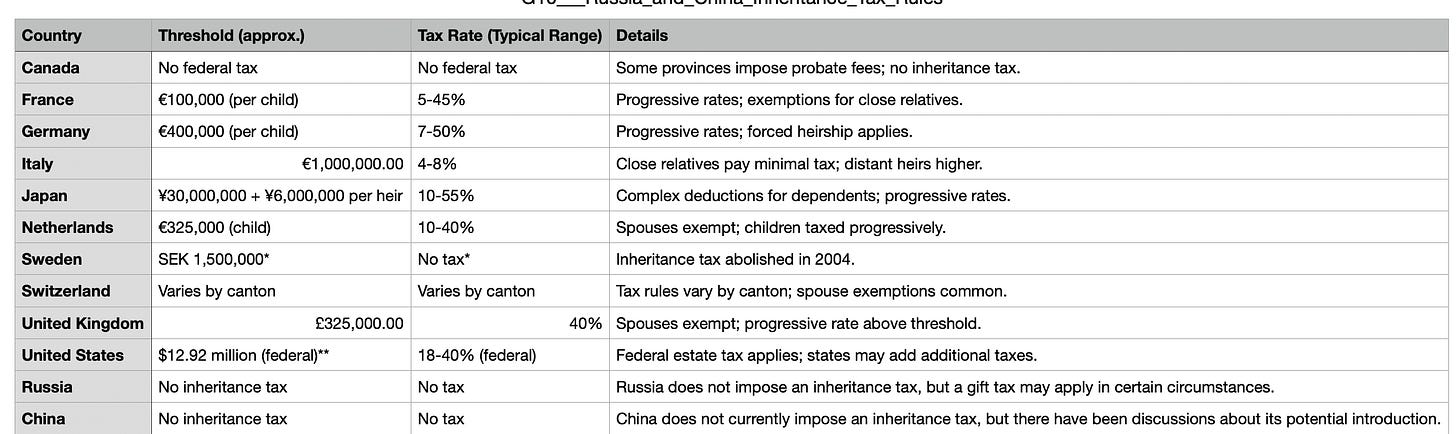

I thought I would look at what other nations do. I looked at the G10 + China and Russia. It runs out nation states are really different.

Sweden stood out for me as basically having no IHT. Sweden is viewed as progressive, and IHT is often viewed as a progressive idea. China having no IHT chimes with the idea of intergenerational family wealth being kept. Italy also has very low tax rates.

Canada has no IHT, but at death you have to crysalise capital gains, which makes some sense to me. Australia has something similar. So, Countries like Canada, Australia, and New Zealand have no formal inheritance tax, focusing instead on capital gains tax for inherited property/assets.

Nations like the US, UK, Germany, and Japan impose IHT but set thresholds relatively high with the intent that only wealthy estates are affected.

Some countries, such as Russia, China, and India, have opted not to introduce inheritance taxes at all. (Norway abolished IHT in 2014).

Here is a table. Much more variation on this than I thought. And some countries have complex rules depending on families ties eg France.

I was also interested in the major political arguments and economic arguments, for and against.

(Helped by GPT). Top 3 Economic Reasons FOR Inheritance Tax (IHT)

Reduces Wealth Inequality and Improves Economic Mobility

IHT limits the concentration of wealth across generations, ensuring a more equitable distribution of resources in society.

By taxing large estates, IHT prevents wealth from becoming excessively concentrated in a few families, fostering economic mobility and opportunities for others.

Generates Public Revenue

IHT provides governments with a source of revenue that can be reinvested into the economy through public goods like education, infrastructure, and healthcare.

This revenue can offset the need for other, potentially regressive taxes that disproportionately burden lower-income groups.

Encourages Economic Productivity

High inheritance taxes may incentivize individuals to invest, donate, or spend their wealth during their lifetimes rather than leaving it untouched for heirs.

Recipients of smaller inheritances may be more motivated to work and contribute to the economy, avoiding a "wealth complacency" effect.

Top 3 Economic Reasons AGAINST Inheritance Tax (IHT)

Disincentivizes Savings and Investment

The prospect of inheritance taxes can discourage individuals from accumulating and investing wealth during their lifetime, potentially slowing capital formation and economic growth.

Family-owned businesses and farms may face financial strain if heirs are required to sell assets to cover IHT liabilities, reducing long-term productivity.

Administrative Costs and Inefficiency

Implementing and enforcing IHT can be costly, with significant resources spent on valuing estates and managing disputes.

The actual revenue generated by IHT is often relatively small compared to total government income, especially when wealthy individuals exploit loopholes to minimize their tax burden.

Potential Capital Flight and Distorted Economic Behavior

High IHT rates may encourage the wealthy to transfer assets abroad, invest in tax shelters, or use complex financial instruments to avoid taxation.

These behaviors can distort markets, reduce domestic investment, and lead to inefficiencies in resource allocation.

And on social politics:

Top 3 Political / Socio-Political Arguments FOR Inheritance Tax (IHT)

Reduces Intergenerational Privilege and Inequality

IHT helps limit the accumulation of unearned wealth and privilege in a small group of families, promoting a fairer society.

By redistributing wealth through public revenues, IHT fosters greater social mobility, giving more people the opportunity to succeed based on merit rather than inherited advantage.

Supports Public Goods and Social Programs

IHT revenues can be used to fund essential services like healthcare, education, and social welfare, which benefit society as a whole.

Taxing large estates aligns with progressive tax principles, ensuring those with greater means contribute more to society.

Addresses Perceptions of Fairness

Many view it as unjust for vast wealth to be passed down untaxed while others struggle to make ends meet. IHT signals a commitment to social equity.

Politically, IHT can be framed as a tax on the ultra-wealthy, appealing to voters who support reducing economic disparities.

Top 3 Political / Socio-Political Arguments AGAINST Inheritance Tax (IHT)

Perceived Unfairness and Double Taxation

Critics argue that IHT unfairly taxes assets that have already been taxed during the deceased’s lifetime, such as through income or capital gains taxes.

This perception can erode trust in the tax system, especially among middle-income families with modest estates who fear being disproportionately impacted.

Threatens Family Legacies and Small Businesses

IHT can create significant financial burdens for heirs, potentially forcing them to sell family homes, farms, or businesses to pay the tax.

Politically, this can alienate constituencies who see the tax as undermining family continuity and hard-earned wealth.

Can Be Politically Controversial and Alienating

IHT is often unpopular, with critics framing it as a "death tax" that penalizes grieving families.

Politicians may hesitate to support or expand IHT due to its emotional and polarizing nature, particularly in societies where wealth transfer is culturally significant.

Governments are influenced both by economics and politics, and which way a nation has decided to go says something about the culture of how it thinks about inherited wealth. In particular, I found the complexity in Japan and France around family ties, notable and the low to no tax in Italy and Sweden.

One thing I have re-learned is the randomisity of life. We think we are more in control than we are and then unexpected, small probability events surround us. Perhaps, I am unusual in having been on the Thai beaches just before the tsunami, and also Manhattan on 9/11 and now at the conference of the recent shooting.

There is some mixed evidence for "depressive realism," a hypothesis suggesting that individuals with depression perceive certain aspects of reality, particularly negative events, more accurately than those without depression.

I think there might be some weight to the opposite. Typical people need to go about their lives mostly ignoring randomness because you can not plan for all of it.

I believe this sense is why fostering a sense of agency - the idea that you can control your choices - is importance for mental resilience. We do not do well when we feel helpless, and we do better when we feel we have agency.

That is one of the important ideas that comes out of my conversation with Peter Gray and his ideas on play and education. Link to conversation here.

Two items on events. First thanks to all those who came to a Very Bigly Climate Game. It was a lot of fun and food for thought. Will have to see how the game develops. (Players below). Will helpfully write up some thoughts some time.

Second, I am planning to host an UnConference for EV (Emergent Venture winners) and friends in April, in London. Let me know if you think you might want to help out or be involved. It will be a one day conference, likely on a Saturday for EVs plus friends.

Click: Lastly, another final reminder - do come to My Death Show if you’d like to try the performance out.

Thanks for reading!