Free markets, what’s up?

History of free market ideas. Protests in Iran. UK pensions near blow up. Live in wonder! Read Children’s books. Possible Alzheimer’s breakthrough?

This week you should listen to Jacob Soll and me talk about the history of free market ideas. Transcript/video here. Straight to Spotify here.

Investment, UK pension near blow-up?

Iran human rights. Protests.

Free market ideas, a history. Jacob Soll.

How does social progress happen?

Vaclav Smil, energy thinking

Live in wonder! Read Children’s books.

Possible Alzheimer’s breakthrough?

Future Ben events: Panel with Centre for the Study of Existential Risk, 11 October, details here; Guest lecture at LSE, 3 October, mostly to the Accounting course students. Theatre: Totoro (Barbican), 15 Oct. Coney, Climate games City takeover, 15 October. UN PRI, Barcelona, 31 Nov - 2 Dec. If you might be at any of those, let me know. Also, I’m meeting up with the ARIA CEO (innovation). Let me know if you have a good idea for ARIA. Also ARIA are looking for talented people in this area. If you know someone where ARIA might be a fit, let me know!

Links: Great teams are 10x average teams. Patrick Collison on Progress. Why do we have a 5 day week? RIP Hilary Mantel.

Sitting this week in a large investment conference and the world of companies still turns. Yes, inflation and recession are constant topics. Many “consumer discretionary” companies (ie shops selling you stuff you don’t really need) have missed their expectations for the year and are indicating challenges.

The risk from geopolitics (Taiwan, China, Russia), supply chain, energy are producing business planning challenges. Resiliency, dual supply, a fight for talent, balancing hybrid/remote working are producing a much wider range of possible outcomes than is average.

Through this many companies are still innovating and meeting their purposes. In any case, this makes many companies long-term seem cautiously optimistic about their trajectory but investors quite gloomy at the moment.

I was asked to explain what the UK government is doing. (!) I believe to critique policy ideas it is helpful to know why these ideas come about and what might be worth saving. To this end my conversation with Jacob Soll is useful to know the long arc of free market ideas. Transcript/video here.

I was also going to write about the UK pension challenges this week due to “liability driven investment”, LDI. But it turns out Matt Levine has written about this better, so check that out if you want to know what has happened, Bloomberg here. Every deleveraging story follow this path…

You buy some assets with other people’s money.

The assets go down.

The people — depositors, investors, prime brokers — call you up and say “you used my money to buy assets, and the assets went down, so now I want my money back.”

They have the right to do that.

You have to sell assets to pay them back.

This makes the price of the assets go down more.

Go to Step 2….

Moving along from the LDI UK pension fund challenges… The Truss-Kwarteng policies are best understood as supply-side economic reforms (perhaps the ideas of Nobel economist Robert Mundel as the best starting point see New republic (2021) profile here on supply-side thinking and this IMF interview (2006) here.)

The idea is that (1) tax is primarily for incentives (rather than fair (re)distribution). And more recently that (2) regulations should not be barriers to meeting market demand. (Eg planning for wind farms, occupational licensing for eg hairdressers, child care).

So re (1) the idea is that cutting tax on the top 1% might make them more productive and lead to more growth of the overall pie. You can argue that won’t happen (and many in the top 1% do argue this), but that’s the idea. You can also dislike the cut on a distributional / fairness basis but it’s supposedly not the point.

The other idea (2) is that there needs to be easier permitting for eg wind farms. Now the birds are not going to like it. Wind farms kill birds. But it’s good for renewable energy and domestic energy security. This is supposedly a supply side reform. Again the politics might be challenging as local communities, RSPB, National Trust won’t like it. It’s something to consider for whichever government is next in power.

Progressive supply-side reform supporters might do well to think where they can/should spend political capital; and also where they may not need to in order to push through easier permittting.

From the progressive side, Adam Tooze had a good go at understanding the ideas but did mostly have to turn to conservative commentators to understand.

In any case, the UK Pension problems over liability driven investment, LDI, were not intentionally directly caused by the new policies, but due to to the use of derivatives and margin in the UK gilt market by UK defined benefit pension funds - as described by Matt Levine above.

But certainly it’s been a “lively” week.

On Free Markets

The long road to making “markets more free” by reducing regulation, or by shaping them via state interventions, seems to start in quite a major way in the teachings of Cicero. This is a significant learning I had reading Jacob Soll’s book and speaking to him. Markets have and always will need a level of social rules to guide them. Where and how to do this, and how lightly or not, are some of the crucial questions of our time so learning where these ideas have come from I think is insightful.

Transcript/video here with Jacob Soll.

Jacob Soll is a professor of philosophy, history and accounting. His latest book is Free Market: The History of an Idea. Jake has works on the history of accounting, The Reckoning: Financial Accountability and the Rise and Fall of Nations (2014); the influence of Machiavelli, "The Prince" (2005) and Louis XIV’s First minster, Jean-Baptiste Cobert, The Information Master (2009). Jake works on accounting standards and financial transparency as well as the history of ideas.

We discuss if better accounting can save the world by looking at externalities, natural capital and human capital better.

We chat about the central role of Cicero and stoic thought in the history of free market thinkers, and how Cicero was in this respect more influential than Aristotle.

Jake talks about how Christian thinkers, and Franciscan monks thought about free markets and also Alexander Hamilton and Machievelli.

We discuss the role of institutions in shaping thought. Jake argues for the importance of patenting ideas and if UK’s patent office gave the country an edge when the industrial revolution started.

We debate if “idea” or “dream” would be a better word to encompass the historic thinking on free markets.

We discuss the role of culture, to what extent protectionism and some tariffs helped economies develop historically.

We play underrated/overrated on: GDP as a measure, carbon tax, standardized sustainability measures, and UBI, universal basic income.

We end on Jake’s current projects and life advice. Study more serious humanities books!

Don't read easy to read books. I think they are the most destructive thing on our culture; these CEO books. “Pull up your boots and tie your shoes in the morning. Don't let the government give you eggs.” I read some of these books and I'm like, "How is this helping anybody?" Go back and read the kind of books we were reading when we were actually building big states and building things that have proved sustainable. If you don't know what they are, just go back and read great literature and great novels. What is that? Well, you can make a decision. It can come from any country. It can come from any religion, but there are great books. Over centuries I see traditional books that we've decided over time are extremely useful to us. Go back and read those. For me, it's the 19th century novel. It has become Roman and Greek philosophy. It's also become the early works of the fathers of the church which never ceased to fascinate me. The writings of William of Ockham… Those are fascinating books. Read serious books. I really think it's time to put down the Harry Potter and get challenged.

On Iran

Elsewhere in the world - is there revolution potentially happening in Iran? Maybe not this time, but every time the womens’ voices seems to grow louder.

It makes me think on how social progress happens. I don’t think we are exactly sure. I think we have only just started to really understand why we’ve had economic progress (which is om the next podcast coming up.)

Energy historian Vacal Smil

A friend asked about Vaclav Smil who is an energy historian so I mentioned a few things on his thinking. There are some Youtubes which are a good entry point into his views. Often sponsored by interested parties though; this one is quite a good overview, on recent topical points and in particular the use of gas:

I took some notes after a 2017 lecture, when I was first reincarnating my blog: https://www.thendobetter.com/investing/2017/7/19/vaclav-smil-energy-expert-awesome

His annual energy report with JPM, is an energy must read: https://vaclavsmil.com/2021/05/03/annual-j-p-morgan-energy-report-may-2021/

His books are much more challenging as they are so dense, with less narrative: I have read Energy and civilisation; and Energy transitions, which I think you can skim to get a sense of where he stands on the long arc of historic energy transitions. If you were to skim one, I would go for Civilisations as it has such a long arc in it.

He lies between techno-optimists and doomsters; and thinks we are in for an energy transition much like we have had before, so slower than what techno-optimists think; but with much less doom than eg de-growthers. His book on judging growth elements was also pretty interesting although quite esoteric, some tangential blog thoughts on it here.

Katherine Rundell, Donne scholar and acclaimed writer

Live in wonder! Read Children’s books. I’ve been dipping into Katherine Rundell’s book on John Donne and I’ve read some of her children’s books. I’m a fan of so-called children’s books. I say “so-called” as I think they are books for everyone even if children can also read them.

This interview really stresses living in wonder and being alive to the world. I don't’ do it always, but I really try, and think this is what more people should do. Take a step back and take in the immensity of it all, the ugliness and the beauty. I try and do this while jogging along next to JP wherever I am. Anything and everywhere can be wondrous.

Possible Alzheimer’s breakthrough? I track this area quite closely. It’s not completely done. But this is the most promising Alzheimer’s trial and drug so far. If it was me, I’d probably try this along with a GLP-1 as of now.

Links:

I’m meeting up with the ARIA CEO. Let me know if you have a good idea for ARIA. Also ARIA are looking for talented people in this area. If you know someone where ARIA might be a fit, let me know!

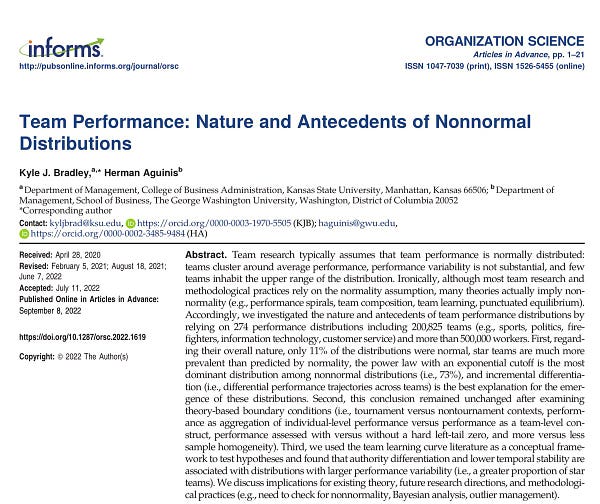

Great teams are 10x average teams.

An overview of what we do and don’t really know about progress.

London. I’m hoping to try some of this out. Do come!

Genius is rejected too.

Supply-side reforms. Again. Explained.

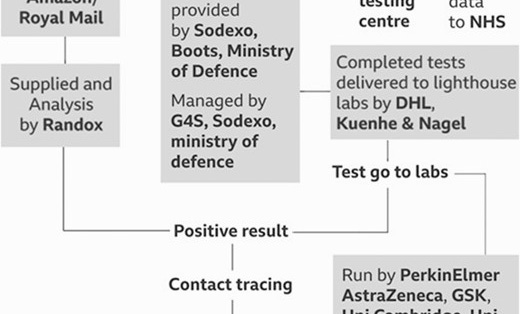

COVID and levelling up policy

RIP, the genius of Hilary Mantel

Tail risks on climate

Why do we have a 5 day week ?